U.S. Single-Family Rents Up 6.6% Year Over Year in May

- The May 2021 increase in rents was nearly four times the May 2020 increase.

- Rent growth of detached properties reached 9.2% in May, while rent growth for attached properties was 3.6%.

Overall Single-Family Rent Growth

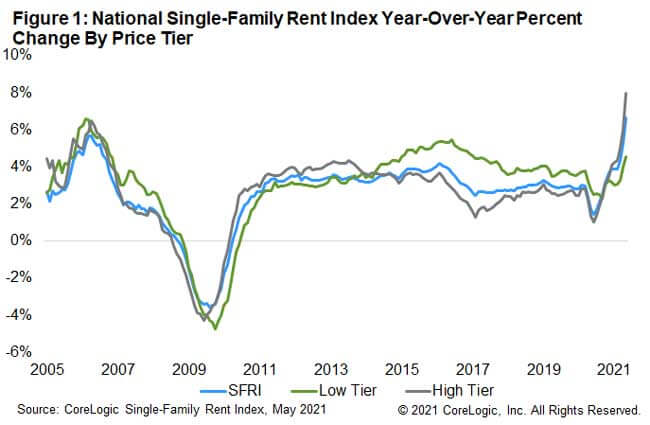

U.S. single-family rent growth increased 6.6% in May 2021, the fastest year-over-year increase since at least January 2005[1], according to the CoreLogic Single-Family Rent Index (SFRI). The May 2021 increase was nearly four times the May 2020 increase. The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time.

Single-Family Rent Growth by Price Tier

An uneven U.S. job recovery, sometimes called a “K-shaped” recovery, is reflected in the rent price growth of the low- and high-price rent tiers, with the increase in lower-priced rentals lagging behind that of higher-priced rentals. The low-price tier is defined as properties with rent prices less than 75% of the regional median, and the high-price tier is defined as properties with rent prices greater than 125% of a region’s median rent (Figure 1).

Rent prices for the low-price tier, increased 4.6% year over year in May 2021, up from 2.7% in May 2020. Meanwhile, high-price rentals increased 7.9% in May 2021, up from a gain of 1.3% in May 2020. This was the fastest increase in low-price rents since January 2017, and the fastest increase in high-price rentals in the history of the SFRI.

Single-Family Rent Growth by Property Type

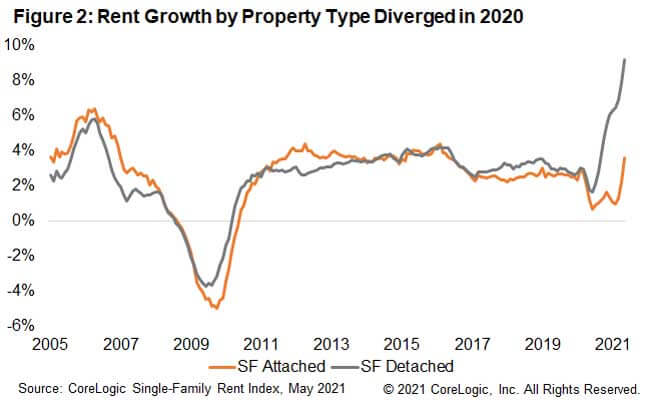

Differences in rent growth by property type emerged after the pandemic as renters sought out standalone properties in lower density areas (Figure 2). The detached property type tier is defined as properties with a free-standing residential building, and the attached property type tier is defined as a single-family dwelling that is attached to other single-family dwellings, which includes duplexes, triplexes, quadplexes, townhouses, row-houses, condos and co-ops.

As demand for more space and outdoor amenities remains, detached rentals in particular are experiencing accelerated growth with a 9.2% year-over-year increase in May, compared to growth of 3.6% annually for attached rentals.

Metro-Level Results

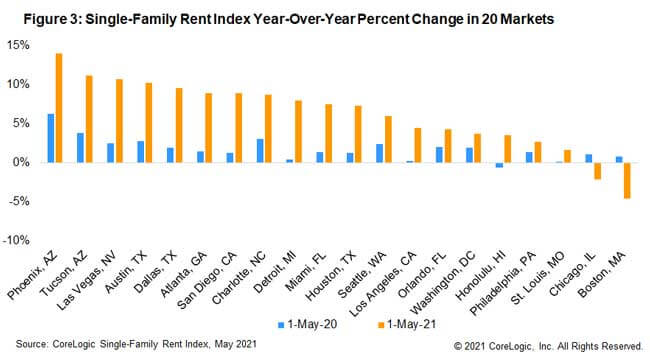

Figure 3 shows the year-over-year change in the rental index for 20 large metropolitan areas in May 2021. Among the 20 metro areas shown, Phoenix stood out with the highest year-over-year rent growth in May as it has for most of the last three years, with an increase of 14%, followed by Tucson, Arizona (+11.1%) and Las Vegas, Nevada (+10.7%). Two metro areas experienced annual declines in rent prices: Boston (-4.5%) and Chicago (-2.1%).

Boston and Chicago were also the only 2 of the 20 metros shown in Figure 3 to have lower rent growth than a year ago with Boston showing a deceleration of 5.4 percentage points and Chicago showing a deceleration of 3.1 percentage points from May 2020.

The slowdown in Boston rent growth might be attributed to college students choosing to forgo large monthly rental payments. Median rent in Boston was $2,800, 1.7 times national median monthly rent. For Chicago, there were large differences in rents of attached versus detached properties. While rent prices of detached rentals in Chicago increased by 5.5%, attached rentals experienced a decrease of 3.3%.

Single-family rents rose by nearly four times the rate from a year earlier in May 2021. Strong job and income growth, as well as fierce competition for for-sale housing, is fueling demand for single-family rentals. Looking ahead, these market forces are expected to remain for much of the year and keep rent increases high, particularly in urban areas and tech hubs as more people return to working in person.

© 2021 CoreLogic, Inc. , All rights reserved.

[1] The Single-Family Rent Index series begins in January 2004.